It’s currently the Golden Age for fintech companies worldwide. Is Israel keeping up?

I always say that my role as a VC isn’t to be a prophet but rather to be an observer. No one (especially not investors) knows what “the next big thing” will be or what the upcoming trends are. But if anyone comes close to achieving that level of prophecy, it’s the entrepreneurs who are involved in facilitating those trends and actually building the next big thing.

That being said, it is indeed part of my job to have and form opinions about interesting areas of technology. As the famous saying goes, having strong opinions loosely held is the key. But part of that saying is having strong opinions. And one area in which I have started to develop strong opinions in is Fintech.

It’s impossible to write anything about fintech without acknowledging the incredible past few months for the industry. Below is a quick list of some of the more high-profile exits in the space of late:

- Morgan Stanley acquired ETrade for $13bn

- Intuit acquired Credit Karma for $7bn

- Visa acquired Plaid for $5.3bn

- Paypal acquired Honey for $4bn

- Ally acquired Cardworks for $2.3bn

- LendingClub acquired Radius Bank for $185m

Several individuals have written eloquently on the importance of each of these acquisitions (see: Ben Thompson, Semil Shah, Sheel Monhot), but it’s clear that fintech is on a historic run. So what does all of this mean for Israel?

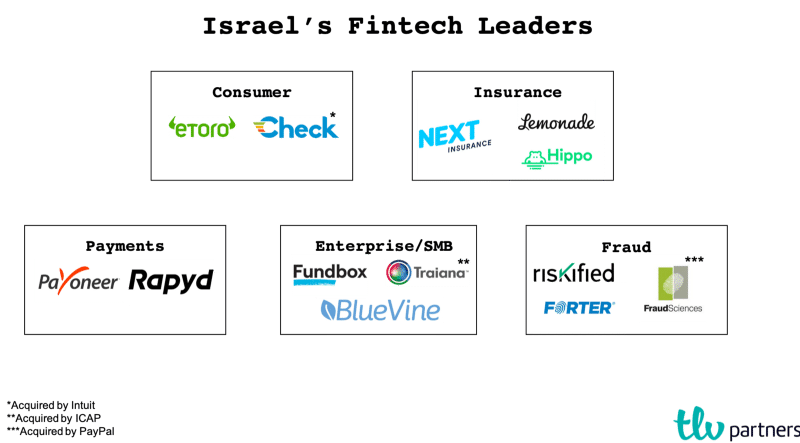

Israel’s role in fintech is and has been significant, with several large and successful companies calling the startup nation home. Let’s take a step back and look at the leading companies and areas within fintech that the Israel ecosystem has produced.

It’s interesting to note that Israel has produced meaningful companies across several major fintech categories. Although if compared to industries such as Cyber Security, Semiconductors and Automotive where Israel has historically positioned itself as a global leader, Israel’s global influence in fintech has not been felt as strongly. There are several potential explanations for this which are out of scope for this post, but there’s no reason that Israel can’t become thought of as a global fintech leader in the future. In order to accomplish that though, a new generation of fintechs will need to be started, as the market is rapidly evolving.

So what will be the defining trends for fintech in Israel in the next few years? I will not be so bold as to attempt to prophesy as to what the next generation will look like. However, what I can do, (in classic YC style) is publish a call for startups in certain areas of fintech that I have observed could use some touching up.

- Open Source Banking Infrastructure

There is a clear need for innovation on the core banking infrastructure front. Banks and traditional financial institutions were created to interface with retail consumers. But the rise of fintech has seen the emergence of a new class of consumers that banks simply aren’t built to handle: developers. Developers creating today’s and tomorrow’s fintech companies need to access these financial services capabilities in order to build their applications. And as anyone who has had experience partnering with a bank can tell you — the current infrastructure needs an upgrade.

The leading players in this market today are Fiserv (founded in 1984) and FIS (founded in 1968), whose respective market caps (as of February 2020) are $83bn and $95bn! As I alluded to above, these companies are quite the opposite of developer friendly, and I believe that there is a significant opportunity for someone to develop an open source Fiserv, built for developers by developers. And as opposed to these legacy players who typically provide a myriad of banking infrastructure products to banks, there’s no reason why certain services couldn’t be modularized by open source. In the not so distant future, there could be an entire suite of open source financial products like an open source ACH system or an open source payment processor.

2. Vertical focused software tools

One of the first things that comes to mind when thinking about financial services is regulation. Namely, that the financial industry is one of the most heavily regulated industries in the world. And for good reason! Companies that control the storage, management and flow of our money should be kept to the most scrupulous of standards. That being said, regulation poses its own set of complications such as increased levels of red tape and decreased levels of agility. This though, creates an opportunity for startups to build software tools dedicated for the financial services industry that are built to meet the regulatory requirements in place.

A great example of this is Symphony which offers a sort of Slack for the financial industry. Extending that model then, shouldn’t there be a finance focused CRM, HR/benefits platform, and others that are compliant from day one?

3. Compliance in a box

Speaking of compliance, I believe compliance represents an opportunity in it of itself. Today the path towards compliance for aspiring fintechs is quite daunting. It goes something like this:

You decide to start a fintech company — to legally offer financial services you find a potential partner bank — the bank then asks you for your infosec policy — and your EFT policy — and your data protection policy — and for a list of tens of additional policies that you must have outlined and incorporated into your business in order to begin the process with the banks. This process could take years to complete before you’ve even had the chance to actually build the service or product you set out to build in the first place.

There’s no reason why this process couldn’t be streamlined to a certain extent, just as other companies have done for other areas of compliance/bureaucracy. Good examples of this are VGS for Soc2 and PCI compliance or Clerky/Stripe Atlas for company formation.

4. Embedded Finance

Similar to how software ate the world, financial services are coming in for a bite as well. Enterprises and startups that have reached a certain level of scale have realized that offering financial services such as debit card issuance, checking and savings accounts, ACH transfers, loans and others to consumers both increases customer retention and customer value. Uber Money and Shopify Capital are two great examples of this. As many have pointed out, an increasing number of companies will look to offer their customers financial services in the future.

The problem, is that offering these services requires a bank charter or partnering with an existing bank, both of which are fairly difficult to achieve if not a full time focus. But assuming one of the above is achieved, there exists a slew of R&D challenges — namely, banks weren’t built to interface with developers. A new wave of financial services platforms that help to better facilitate the communication and collaboration between traditional financial institutions and the fintechs of tomorrow will need to be created, so why not by Israelis?

5. Next-gen insuretech

While companies challenging the insurance incumbents with software based offerings are experiencing rapid growth (see above), the overall model for how individuals consume insurance products has remained constant. The amount of insurance products an individual has is wide ranging: health insurance, home insurance, life insurance, auto insurance, travel insurance, warranties for smartphones/laptops, valuables insurance and many others. What’s more — within each of these insurance products exists several sub-products and a myriad of options for how inclusive of a of policy one would like to purchase. This leads to a less than ideal customer experience where the majority of people don’t have full visibility into their full coverage and have to deal with a different provider for each category. I think that the future of insurance consumption should be through one provider. This could be in the form of a marketplace, an aggregator or another model that doesn’t yet exist. But a company that creates a platform that acts as the centralized contact point for all insurance payments, claims and support is one I’d like to speak to.

Looking Ahead

Will one of these areas lead to the next category defining fintech company out of Israel? I sure hope so, and if you’re working on something similar or interested in working on one of these issues please get in touch. And if you’re an entrepreneur reading this post and your takeaway is that I have it all wrong — I’d love to hear why. After all, these opinions are quite loosely held.

Thanks to Itai Damti, Doron Somech, Rona Segev, Eitan Bek and Brian Sack for their help and input