Last month, we hosted our annual LP meeting (unfortunately over zoom). During the meeting, we presented our LPs with updates on the TLVP portfolio, the state of Israel’s startup ecosystem and were privileged to have some of our founders present their companies.

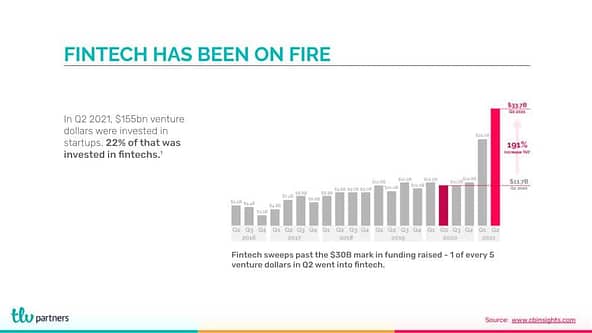

We also presented our thesis on the state of Israeli fintech. We thought that focusing on fintech was relevant because, unless you live under a rock, you have probably noticed the hype surrounding fintech at the moment.

What follows is a summary of that presentation.

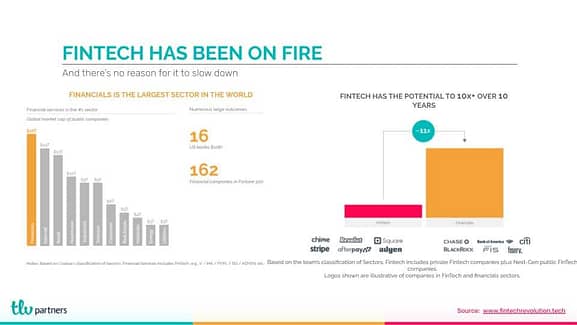

What’s important to note here, is that while fintech is indeed in the midst of an historic run, there is still a significant amount of growth that we can expect from fintech as a category. Legacy financial services firms represent $16tn of global market cap value, and as fintech continues to eat into the legacy financial services pie, it will continue to grow accordingly.

What has led us to the current explosion in fintech though?

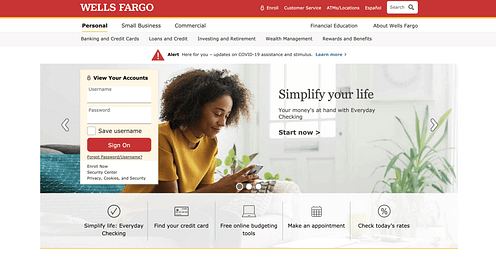

The answer to that question can be found in the famous Jim Barksdale quote that there are only two ways to make money in business: through bundling and unbundling. To explain what I mean, let’s take a look at Wells Fargo’s homepage.

There are an astounding number of different financial services that each site visitor is met with right away. Everything from credit cards to personal finance management to loans. And that’s probably not surprising, because banks have traditionally offered a bundle of different financial services. They served as the centralized destination for all things that relate to money.

But if we all remember our econ 101 class, specialization is an important economic principle. And startups recognized this. Consumers and businesses were not thrilled with the products being delivered to them by banks, mostly because they weren’t built for the modern day customer.

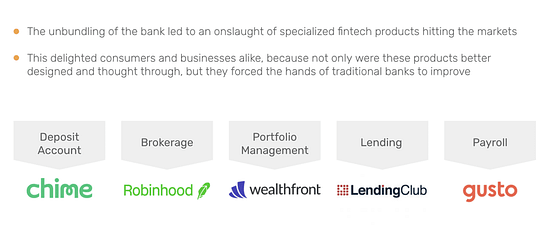

And that’s what brings us to fintech 1.0 – the unbundling of the bank. This era of fintech was defined by peeling off the layers of the bank and providing customers with specializied, digitally native alternatives.

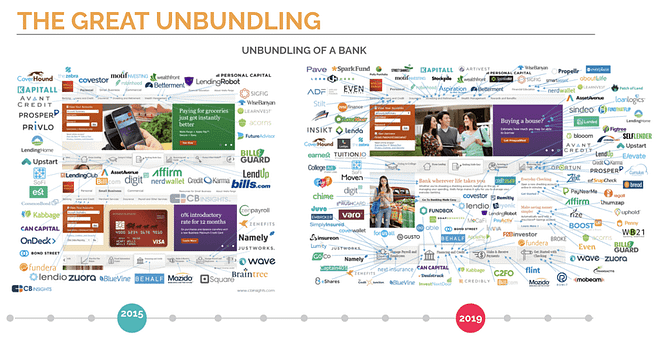

CBinsights has a great graphic demonstrating this, by taking the same Wells Fargo homepage, and decorating it with all of the fintech startups that came to unbundle it.

Notice that CBinsights put toghether this graphic in 2015 and 2019, and the number of companies close to tripled in that time span. Some massive companies were built as a result of this fintech wave, firmly establishing fintech as one of the leading sectors of technology.

Here at TLVP, we invested in a few companies that can be considered part of the unbundling era of fintech, mostly notably Next Insurance, which is a digitally native small business commercial insurer, and Mesh, which is a modern day corporate expense management platform.

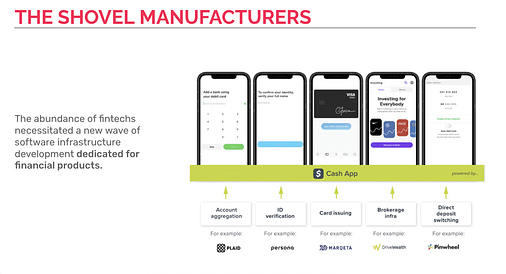

The next wave of fintech though plays upon a different quote, this time more of a metaphor. And that is: “during a gold rush, sell shovels”.

The onslaught of new fintech companies as a result of the unbundling phase, gave rise to a complete rework of the software infrastructure that powers said fintech companies. Beyond the unique qualities that fintech companies have (compliance, security, etc…), building vertical specific software infrastructure for fintech was finally a viable business plan due to the rapidly growing TAM.

Examples of companies in this infrastructure wave can also be found in our portfolio with companies like Unit, which has built a banking as a service platform enabling any company to embed financial services within their product, and Benga, which is an API for credit worthiness assessment, allowing any company to seamlessly offer credit based products.

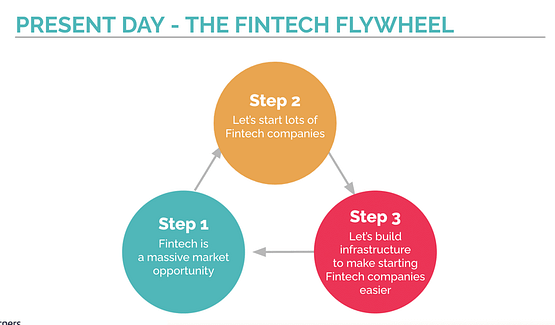

After going through a quick history of how fintech has developed, we’ve now arrived at the present day can be referred to as the fintech flywheel era. As displayed in the image above, the recognition that fintech is a massive market opportunity leads to an abundance of fintech companies getting started, which in turn, leads to the creation of vertical specific infrastructure.

That infrastructure makes it simpler to start a fintech company, which increases the overall potential and ubiquity of fintech as a category – and the virtuous cycle begins again.

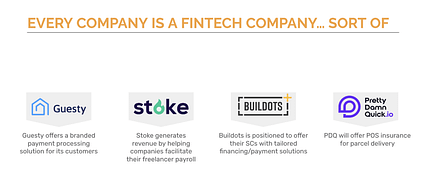

This golden age of fintech, has led many to label fintech as an equivalent to “software”, birthing the phrase: every company is a fintech company. And while there is some truth to that statement, a more accurate depiction of the state of fintech would be that fintech is undergoing a shift from a vertical to a horizontally applied strategy.

The aforementioned Unit plays a big role in this, but essentially fintech has become a business model.

In the image above there are four additional TLVP investments, none of which would traditionally be considered fintech companies. However, each of them has a fintech strategy because incorporating payments, insurance, lending or other financial services is simply the best way to provide maximal value to customers.

(As a quick aside, it’s interesting to note that another trend in today’s fintech ecosystem is the re-bundling of financial services as the rise of super apps like Cash App, Chime, Robinhood and others attempt to maximize customer life time value by up-selling their users with additional financial services. As was mentioned, there’s only two ways to make money is business 🙂

So how does this relate to Israel?

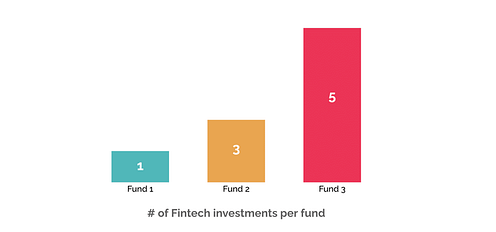

First of all, it’s interesting to note that fintech has taken an increasingly important position within TLVP.

In fund 1, we only made one fintech investment, and in our previous fund, fund 3, we made five fintech investments, accounting for a third of the entire fund.

But is Israel well positioned to make an impact on the global fintech scene? Indeed, Israel’s local financial services market in underwhelming to say the least.

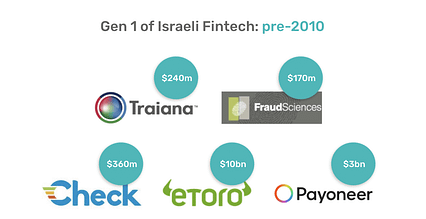

Unsurprisingly, the first generation of Israeli fintech, companies founded prior to 2010, wasn’t particularly inspiring. There wasn’t a large volume of success stories, although there were some clearly important fintech stories during that time.

Five successful companies does not an ecosystem make however. But the seeds were planted. And gen 2 of Israeli fintech was already significantly more interesting.

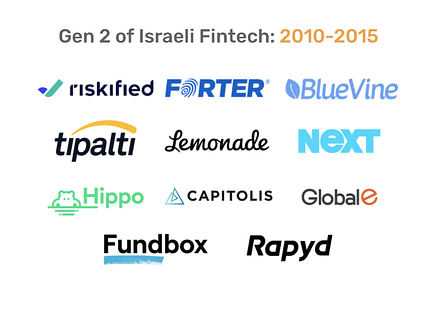

In no time, Israel’s fintech ecosystem became globally impactful. And as ecosystems go, there was a 2x increase in the number of successful companies between these two generations. Interestingly enough, many of the successful companies in gen 2 can trace their lineage directly to one of the companies in gen 1.

And thus we’ve arrived at not only the golden age for fintech globally, but also locally.

In Israel today, there is a wealth of knowledge, an abundance of talented engineers, product managers, account managers and more who know what it takes to build a fintech company, and an incredible list of role models that have paved the way for another generation of Israeli fintech founders to succeed.

This is why we’re so bullish on Israeli fintech, and we couldn’t be more excited to see what comes next.

P.S. – the elephant, or the ape, in the room is DeFi/web3. While addressing our thoughts on that topic is beyond the scope of this post, what we can say is that we’re very excited about recent developments and it seems that we’re on the cusp of a paradigm shift. That said, locally, there has yet to be a migration of top tier talent to the space, and until then, we’re not sure how well positioned Israel is to build meaningful companies in the space. Of course, Fireblocks and Starkware are listed in the image above, so perhaps the breadcrumbs are already there.