The rise of new industries and the disruption of old ones strongly rely on the venture capital paradigm. Hence, like corporates, we must acknowledge our influence on the markets and take responsibility

Economies are dualistic creatures. On the one hand, they develop according to the current market forces in a given ecosystem. On the other hand, they create and influence the environments and societies they inhabit. Sometimes this complex interplay becomes unhinged, and the economy loses touch with — well, reality. The “CEO’s Letter” published last year (Long before Covid-19 came) is a case in point. The letter, signed by The Business Roundtable, a group of CEOs of nearly 200 major U.S. corporations including Apple, Amazon, IBM and JP Morgan, declared that maximizing shareholder profits can’t remain the sole objective of business enterprises, who need to align themselves to more diversified goals. The letter was a wake-up call, and the start of a conversation. Another adjustment of a great economy.

I would like to argue that like corporations, venture capital firms play an important role in building new industries that influence the economy and mold society. Hence, they must take an active stance on societal issues.

Venture capital firms are an odd beast. Not a company, not really a financial institute, quite fashionable and sometimes even glamorous — for young startups. Venture capital firms manage large sums of money, usually with very minor bureaucracy and regulation, and are considered knowledge hubs for technological innovation and the advancement of budding tech companies. Their mandate is clear — to create yield for investors. However, VCs shaping the future (mostly through technology). The rise of new industries and the disruption of old ones strongly relies on the venture capital paradigm. Some even argue that VC is eating the world. Hence, like big companies, they (we) must acknowledge their influence on the markets and take responsibility.

On Power and Responsibility

In that capacity, VC firms can influence the success of entrepreneurs by defining the ecosystems that are ripe for business and delineating the ones that are currently considered a waste of time and money. Innovation dances, at least to some extent, to the VC fiddle. VCs have a huge impact on our digital life, our economy, and society at large. They are the ones who often crown the people who will go on to build businesses and markets, define the ideas that are worth pursuing, and how.

But with power comes responsibility. Like large tech companies that are becoming increasingly involved in values beyond profit maximization — i.e., by creating Corporate Social Responsibility (CSR) teams, or internal “Doing Good” initiatives — Venture Capital firms should take a stronger stance in the betterment of the ecosystem within which they operate. This doesn’t mean that they should invest against their model, but rather that they need to diversify their investments, be aware of its implications.

We can also discuss the talent who’s responsible for the change. Typically (not always), entrepreneurs that are positioned for funding are a-priori privileged, coming from the backgrounds that gave them the support — financial, emotional, academic etc. — they needed to excel. But VCs need to take an active role in helping more societies to grow entrepreneurs from much more varied backgrounds and populations. Again, not investing in someone just because he/she comes from a certain area — rather work with younger generations and give them the tools and confidence to do so in the future. Such a proactive approach by the private market with the right support by the state will help to create a greater economy and more innovation.

We need to make sure that we are not contributing to the growth of inequality, not jeopardizing the environment. But rather, that we’re using our power and our investment model to create a more inclusive, connected society, that brings together people with a variety of narratives. VC firms need to remain constantly aware of the environment they are building along with their portfolio companies. They need to step in and act.

Connecting the Bedouin Society

There are several examples made by local VCs. to name a few — “Power in Diversity” or the “Olim” program. Here’s another example I can relate first hand.

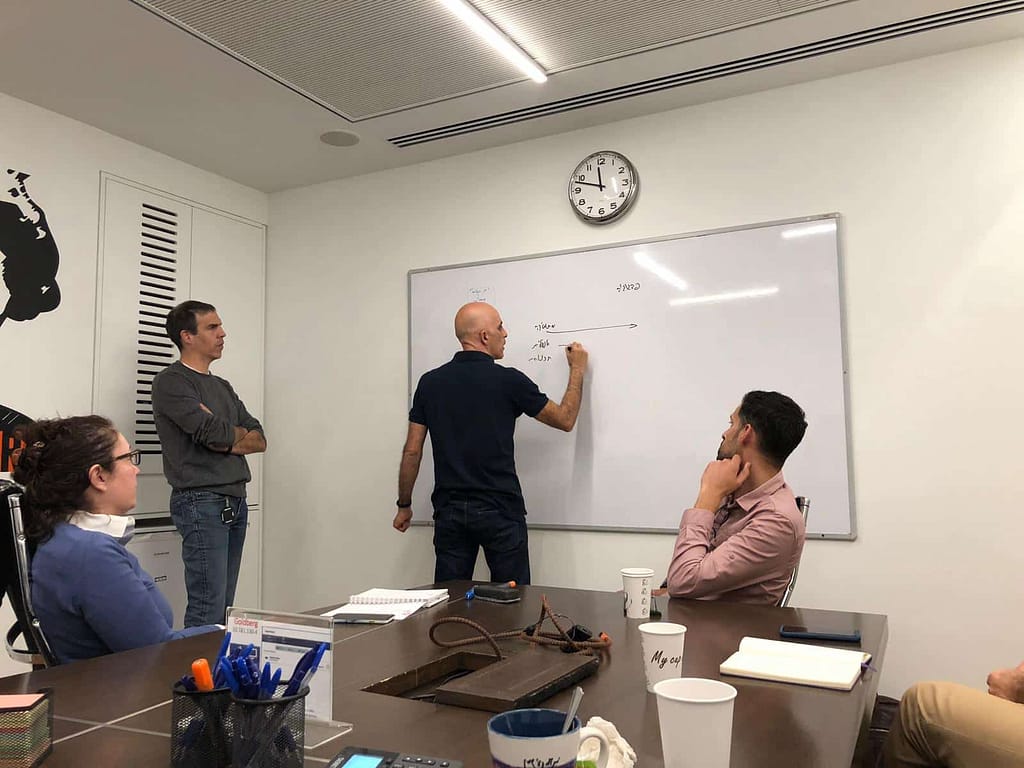

“Enter” is a training and placement program for the Arab-Bedouin society. The program, which was launched last year, is geared at connecting the Bedouins living in the southern region of Israel to its booming high-tech industry. A preliminary study we conducted found that only ten (10!) Bedouins hold core dev positions in tech companies — out of a population of 300K. This is a staggeringly low percentage which calls attention to the inequality between different populations.

We helped 24 talented women and men to do what they were dreaming of — study coding — and working for a tech company. Our next step is to get into schools and support younger generations.

The Enter Project is just one example. I was lucky enough to be among its founders which include guys from the Bedouin community and tech veterans, and alongside Appleseeds NGO. Funding and support were given by the Ministry of Agriculture, and a few more techies like Mellanox, Dell-EMC, Cadence, Western Digital, DB Motion, Siraj, Natural Intelligence, Datorama (SalesForce), Google Campus, Cisco, Nokia, Qumra Capital. TLV Partners was the first private investor in the project and opened the door for many others.

The free market is alive and kicking. So is big money. But it’s important to stay in touch with the ecosystem big money is erecting — who it favors, and who it favors less. VC firms need to be dominant players in social-economic activities, both as funders and as consultants — for and along with the dozens of companies they’re helping to build and grow.