Participating preferred is less profitable for both the A investor and the founders.

And it creates a weighty potential misalignment.

There is a common belief that participating preferred is always better for investors.

Here’s a brief overview of the various liquidation preferences investors may ask for. Liquidation preferences determine how to divide the proceeds from the exit.

- Pro-rata distribution: Each shareholder receives their percentage in the company. i.e. — shareholders that hold 20% receive $20M in an exit of $100M, 20%x$100M=$20M).

- Non-participating preferred: The investors receive their money back OR pro-rata distribution. Whichever yields more money to the investor.

- 1x participating preferred: The investor get their money AND pro-rata distribution. This is often referred to as “double dipping”.

- 2x+ participating preferred: The investor get 2x on their money AND pro-rata distribution. In some cases, investors ask for a higher multiple — 3x-5x.

- Interest: Investors often ask for annual interest of 4–8% on their investment.

VCs have one common goal — they all aim to increase shareholder’s value. Many Israeli entrepreneurs share this dream as they want to build long-lasting companies. This alignment of interests makes sure everyone is working to achieve the same goal.

Yet, participating preferred creates an inherent misalignment of interest between VCs and entrepreneurs.

Take for example an entrepreneur who faces a decision whether to sell the company now for $150m. His investors agree that the company’s potential could be much higher in 2–3 years. But the company would have to raise another $20M to reach said potential. Luckily, there is a late stage investor who is eager to invest in the company at a reasonable valuation. The decision should be simple — a good opportunity to increase the value at a reasonable price. But here is where the participating preferred misalignment kicks in. The entrepreneur, upon an exit, will have to pay back an extra $20m plus interest before seeing any profits. Not to mention the fact that he/she will be further diluted. VCs are professional investors and part of their job description is to take risks. Entrepreneurs are dreamers that dedicate their life to build companies. Some entrepreneurs at this point will decide to sell the company and reduce their personal risk. The investors will lose much more than the potential profit from the participating preferred.

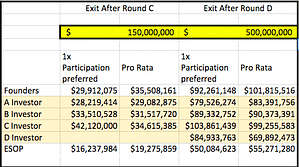

To illustrate the potential financial outcome in different scenarios, I used our cap table template with some modifications. ( you are welcome to play with it using this link ) Below you can see an example.

In the above example, the C Round investor will receive $103M in case of $500M exit opposed to $42M in the case of a $150M exit. Despite the further dilution caused by the D round and the participating preferred. In short, increasing the company’s value is more beneficial than participating preferred. Participating preferred incentivize entrepreneurs to sell early, thus are not good for investors.

If you take another look at the examples above, you will notice that for the A investors participating preferred is not profitable in both scenarios.

The reason is quite simple but not intuitive. A round investors take the highest risk as they invest early, and their reward is a lower price per share. Even if they continue to invest in future rounds, on average their price per share is lower. Thus, they payed less than the other investors for each percentage.

With participating preferred the shareholders get money back according to the amount they invested. But for the A investors it is always better to divide the money according to the percentage in the company. The series A investors will see a higher return, because they paid less for their percentage.

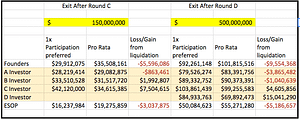

Below you can see the same example as above. We added the loss/gain for each shareholder based on the liquidation preference.

As you can see, in both cases the A shareholders are better of sticking to pro-rata distribution. Their position becomes worse as more money is raised. Similarly to the position of the founders and the employees, although not as extreme.

To conclude: with participating preferred, the A round investors are giving a large share of their profit to the late stage investors.

Over the past few years, many early stage funds have stopped requesting participating preferred. While this is mostly due to the competition between VCs, some have no-doubt came to the above realization. Still, many funds insist on including participating preferred in their term sheets.

Go To CapTable with participating preferred

For more explanations on CapTables and exit Scenarios, you can check our post.