Small businesses are the bedrock of the global economy. Whether it’s a corner coffee shop, a local bakery, an artisanal clothing store or the best blankets to assure a good night’s sleep, we are surrounded by small businesses that produce superior quality products.

While historically these businesses may have only been discoverable while walking down Main Street, we are at a tipping point in global purchasing power. Millennials and Gen-Zs, who prefer to purchase goods online, are transitioning to become the highest earners in the economy, and even Gen-X’ers have shifted their buying habits to mostly online.

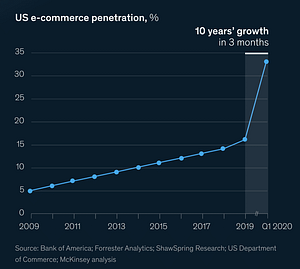

This might sound obvious, but as the image above displays – the vast majority of retail sales still occur in the physical world. That said, as the above image also demonstrates – the global pandemic was a watershed moment for ecommerce. Covid-19 forced traditionally offline businesses to create an online presence, and pushed consumers to browse online as opposed to meander down the street.

Paradigm Shift

To further drive home just how staggering the growth of ecommerce has been over the past few years, look no further than the phenomenon that is Shopify. The number of Shopify merchants increased from 41,000 in 2012 to 1.75 million in 2020. The GMV of Shopify grew accordingly, with $707m in 2012 and $119bn in 2020 (through H1 2021, GMV already surpassed $80bn).

This growth is undoubtedly impressive. But it gets more impressive when you take a look at the growth that occurred strictly between 2019 and 2020. Shopify’s GMV nearly doubled between those two years, from $61bn in 2019 to the aforementioned $119bn in 2021, and 750,000 new merchants joined the platform during that time frame.

Here’s Shopify President Harley Finklestein’s commentary of some of their recent growth:

Unpopular opinion: The Great Resignation is total bullsh*t. Yes, we are seeing turnover, but these people are not leaving the workforce. They are intolerant of bad jobs.

— Harley Finkelstein (@harleyf) January 24, 2022

Whether or not we’re in the midst of a Great Resignation or a Great Reinvention, one thing is clear: the era of ecommerce has arrived.

Specifically, we’ve entered the second generation of ecommerce.

Gen 1 of ecommerce was focused on enabling large retailers to adjust to the reality of the internet. But Gen 2 of ecommerce is focused on empowering micro, nano and small businesses to compete with their much bigger counterparts.

Israel & eCommerce

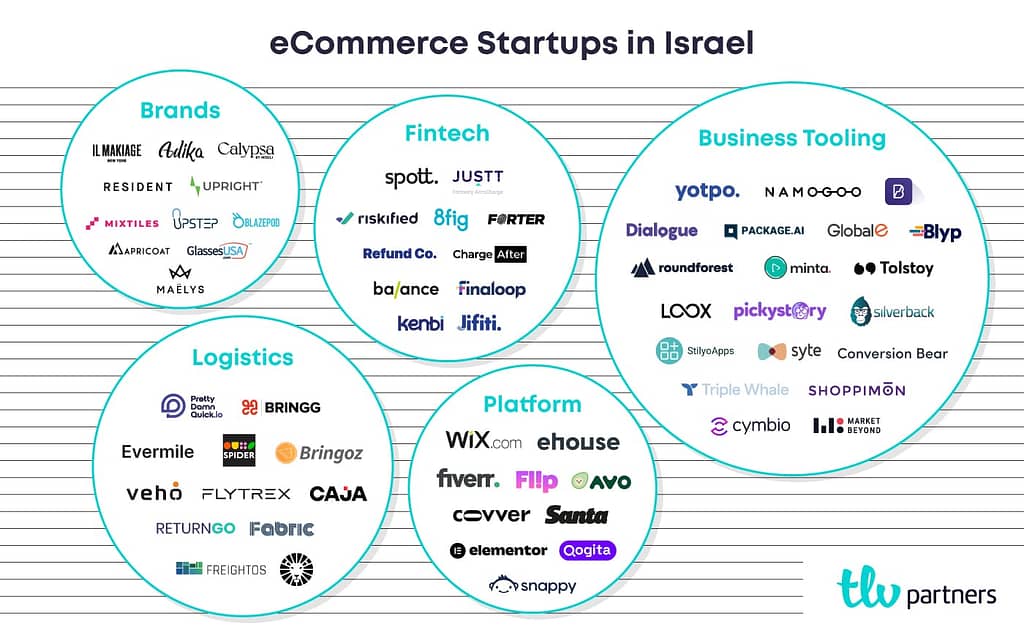

Despite the agony of dealing with Israel’s postal service, the Israeli startup community has positioned itself well to capitalize on the current/coming onslaught of ecommerce innovation.

The above companies, three of which are public, have paved the way for the next generation of Israeli ecommerce founders. Already at TLVP, we have seen a sharp increase in the number of founders who developed expertise in ecommerce through their experiences at some of the above companies. Thus is the path towards market maturation.

So as we look ahead towards what is already taking place and what is surely to continue to come, here are the five key areas of ecommerce innovation within Israel.

Let’s take a quick look into each category.

Every eCommerce Company is a Fintech Company

What was the impetus for fintech? Why did the world need to digitize its financial services? Quite simply, once the demand for goods and services came online, there was a need for a means by which to transact these goods and services. And vice versa.

The truth is, ecommerce and fintech are close siblings, perhaps even twins. You cannot mention one without the other, and you definitely can’t have one without the other.

Philosophy aside though, financial services for merchants is one of the areas that has produced some of Israel’s most successful ecommerce related companies. Fraud prevention tools like Riskified and Forter represent the aforementioned Gen 1 of ecommerce.

And beyond fraud prevention, entire categories of fintech are focused on enhancing the merchant and consumer experience online. BNPL companies like Afterpay and Affirm are a perfect example of this (with Israeli companies Chargeafter and Jifiti putting their own spin on it).

But newer models are coming front and center as well. Balance, Refundco, Kenbi and 8fig are all great examples of this.

Some areas that we’re interested in:

- Financing has been predominantly reserved for Amazon FBA sellers, and for good reason – it was the dominant ecommerce marketplace for Gen 1. But as we shift towards Gen 2, the baton is being passed to Shopify and there exists a significant opportunity to build Shopify native financing solutions (Shopify actually already offers a financing solution for their merchants, but as more and more Shopify merchants go multi-channel, there is white space for a third party financing solution)

- Insurance – whether it’s product liability insurance for merchants, nano insurance policies for consumers to purchase at checkout for their goods or downtime insurance for Shopify merchants, we believe there are plenty of opportunities to innovate when it comes to the intersection of ecommerce and insurance

- Cross Border – One of the biggest pains that ecommerce merchants have is selling their goods internationally. Global reach can be achieved through today’s distribution channels, but this severely complicates back office tasks such as taxes, accounting and collections

Run Forest Run!

We’ve all be brainwashed to expect quick delivery times. Locally we haven’t yet been privileged to experience all of the wonders that is Amazon Prime, but same day delivery is magical.

While the magic is being experienced by customers however, many seem to forget the sheer complexity of getting things from point A to point B in the physical world. One could argue, correctly in my opinion, that Amazon is a logistics company fronting as an ecommerce company. Their ability to deliver goods faster than every other competitor out there, has served as their true long term moat and growth strategy.

Whether through adding their own automated warehouses (see Fabric, Spider) or by using orchestration platforms to help them better manage their own and third party fleets (see Bringg, Bringoz), competing marketplaces and retailers have sought tools to try and catch up.

In parallel, there is a holy war being waged by VC funds attempting to decrease grocery delivery from 15 minutes to 5 minutes in NYC and the sharp increase in consumer demand for ecommerce has led to a supply chain crisis that doesn’t seem to be ending any time soon.

There’s still A LOT to be done when it comes to logistics. Here’s a few areas we’d like to see improved:

- SMBs – as mentioned above, the sheer growth in volume of small, even nano, merchants on platforms like Shopify makes creating a tailored logistics solution for SMBs very intriguing. PrettyDamnQuick is a great example of this

- Circular Economy – the delivery and return of goods have painfully large carbon footprints. The ability to intelligently reduce the harm that ecommerce does to our environment while also improving the delivery or return experience for both customers and merchants is a massive opportunity

- B2B – the vast majority of logistics solutions deal with merchant-consumer transactions. But as B2B marketplaces continue to proliferate the market, they will seek out dedicated logistics providers to help with their specific needs (larger order value, heavier loads, etc…)

Go Big or Go Home

If it isn’t abundantly clear already, we believe that ecommerce represents one of the largest addressable markets in the world today. That means that it’s theoretically viable from a business plan perspective to create niche solutions. In this regard, there are quite a few similarities to the payments industry.

That said, we hope to continue to see some truly ambitious companies in the next few years. Companies like eHouse and Qogita are great examples of this, but unfortunately there aren’t enough yet locally.

Speaking of ambition, 2021 saw THREE Shopify native brands go public, a trend that’s surely to continue to increase. Israel isn’t exactly known for their D2C prowess, but companies like Resident, Mixtiles and Maelys are on the path to buck that trend. Israelis have always been creative and determined – an increase in D2C brands would be a welcome shot of inspiration for the local ecosystem.

Similarly, when it comes to business tooling, gone are the days where investors seem uninterested upon hearing that founders are creating “just a Shopify app”. However, the ecommerce stack for merchants is growing fast, and at some point they will reach a breaking point from a margins perspective.

Who’s going to create a roll-up, not of merchants, but of ecommerce enablement tools?

Ecommerce Nation

Israel has come to be known for their innovation in semiconductors, cyber security and fintech. We believe that ecommerce is the next sector that will become synonymous with Israeli innovation, and we look forward to partnering with ambitious founders who share that vision.