Whenever I get asked: “What do you love most about your job” I always give the same answer. The best part of my job is that I get to meet with incredibly smart and talented entrepreneurs and hear their latest and greatest ideas. The sheer number of talented entrepreneurs out there never ceases to amaze me. But even more than learning about their ideas, I love learning about the entrepreneurs themselves. While most people have some preconception of the archetypal Israeli entrepreneur, an 8200 graduate who has been coding since the age of 9, the truth of the matter is that there is an astoundingly wide range of backgrounds in the Israeli startup ecosystem. And learning about that — is simply the best part about my job.

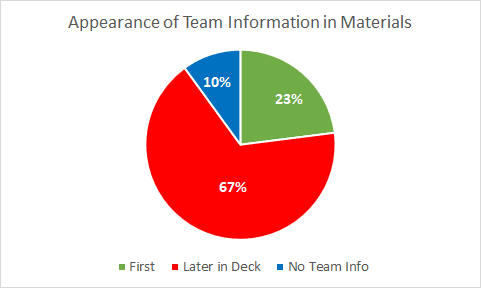

While that’s how I feel, too many founders fail to realize this. Too often I find myself deep into a pitch without hearing one word about the team. It seems that there is a misconception among some Israeli founders that investors care more about the market, technology and traction than they do the team. In fact, of the last 100 presentations I have received 67% of them have not featured the team first and an astounding 10% of them included no information about the team.

The following post is meant to provide founders with both best practices and an inside look at the investor’s rationale as to why the team should be the initial focus of every pitch.

Let’s start with the rationale

Allow me to provide a couple of caveats. Firstly, my opinions are reflective of being an early stage investor. Secondly, every Angel, Associate, Principal, Partner, Firm, etc… has a different approach to the investment decision making process. While I do believe that presenting the team first is applicable across the board, there most definitely are investors who do not agree with this approach.

With that in mind, I find that early stage investments are based 90%+ on the team. Do we care about the size of the market? Of course. Do we like to see a defensible competitive advantage in the form of technology and/or network effects? Sure. Do we salivate at hockey stick growth? You bet. But none of the above are relevant in the first place if we are not impressed by the team. In early stage investing, the best investments are made in markets that do not yet exist, in technologies and network effects that are not yet ripe and in companies with negligible or unsustainable metrics. The only aspect of a startup that can be truly gauged in the early stages is the quality and integrity of the team. It is not simply cliche that most early stage investors would rather invest in a less than innovative idea with a fantastic team, than a disruptive idea with a mediocre team — the fantastic team will, more often than not, find a way to succeed (see: Slack).

This is why investors want to, first and foremost, hear about the the team. But how should you be presenting yourselves? Let’s walk through a couple best practices.

The deck/one pager

Investors receive countless startup materials every day. Often times, your deck or one pager will be an investor’s first impression of your company, and as the saying goes, “You never get a second chance at a first impression.” I’m the first to admit that my consumption of decks is not exactly methodical and may be influenced by my millennial nature . I usually open the link/attachment, scroll through the materials and complete the process in under two minutes. Thus, for me it is crucial that the team slide appear right away so I do not have to search for it, which in turn might lead me to lose interest. It’s ok to have an opening slide that includes a company name and a one liner, but other than that, the team slide should be your first slide.

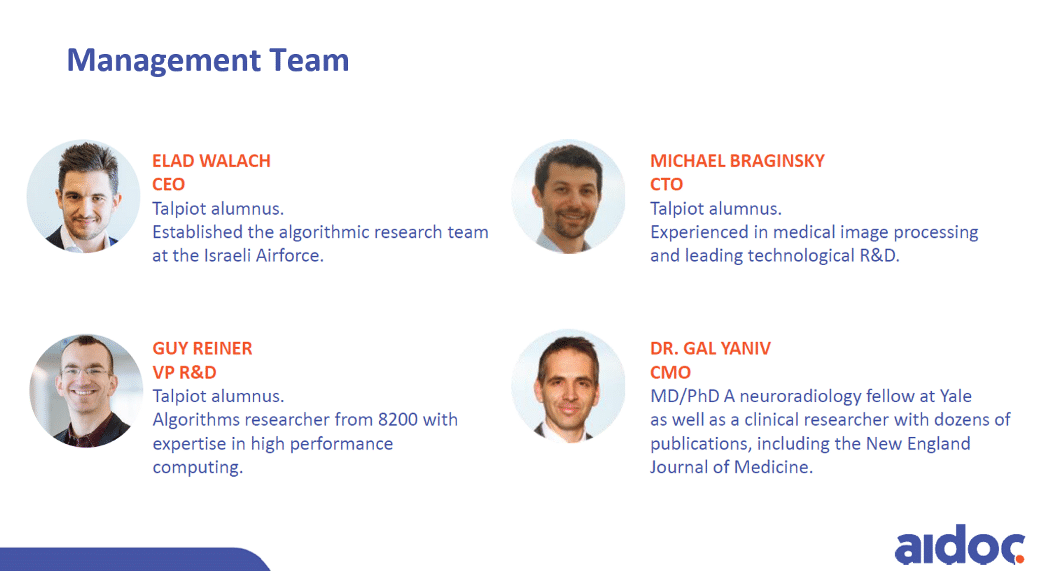

When it comes to representing the team on the slide, the main thing to keep in mind is that it should be visually appealing. Don’t crowd the slide with every position and qualification that the founding team has (surprisingly, it’s not so relevant for investors that you interned at a startup for two weeks when you were 18), but rather provide concise data on your background that you deem relevant for your venture. Additionally, include a small picture of each founder: this can be any image of you that is clear and presentable, such as your Linkedin profile image. Lastly, and this is a personal preference, words speak louder than logos — tell investors what your experience is, don’t make them guess based on logos. One of our portfolio companies, Aidoc, executed this to perfection. Below are the first two slides of the investor deck they used for their A round.

The elevator pitch/phone call

Presenting the team first is a must in all pitch formats — including elevator pitches and investor phone calls. Such conversations often have a time constraint and this might cause you to believe that you need to cram as much information about the market and solution into the little time you have. Resist this urge. The goal of such an interaction should be to pique the investor’s interest and get a second meeting. And once again, investors will more likely be inclined to request a follow up meeting if they are intrigued by the quality and experience of the team.

That being said, this type of interaction is different from a sending a pitch deck that clearly outlines the team’s background. In an elevator pitch, start off with a quick sentence or two about the team in general. For example (let’s use Aidoc again): “We’re a team of deep learning experts from one of the IDF’s most elite technology units who have been working together for over five years.” This succinct approach ensures that the investor remains engaged, and at the same time provides context for why the team is uniquely qualified to be developing the solution that you will describe afterwards. A phone call, on the other hand, is more structured. For that reason, it’s best to spend one minute speaking about each founder individually and their role in the company.

What about the newbies?

While Aidoc’s deck is a great example of the implementation of this principle, not all founders are Talpiot alumni. Many first-time entrepreneurs might not have much on their resume that seems worth speaking about. This causes these founders to save the team slide for the end of the pitch in the hopes that their presentation of the market, solution and traction wins the investor over. In my opinion, this is a critical tactical error. By avoiding a discussion of the team, you are implicitly letting investors know that you lack confidence in yourselves. You don’t have to be a Harvard Graduate, ex-Googler, 8200 alumnus or one of the first employees at last year’s hottest startup, to succeed. Investors need to be convinced that you have a mythical “secret sauce.” In other words, what makes you the right person for the job and where is your passion coming from? This is of utmost importance because passion is the essential ingredient for success in the marathon we call startups. Here are a couple of examples of compelling facts you should include in your pitch, especially if you lack a stellar background:

- “The founding team has been working together/been close friends for an extended period of time”

- “We’ve been in this industry for the past several years, and have experienced the problem firsthand”

- “I’m an industry enthusiast who recognized that a change needed to be made to this traditional industry”

There are many more examples, but at the end of the day, it’s up to you to creatively explain why your team has an unfair advantage.

What’s your story?

While running the risk of sounding redundant (I may have already crossed that line), I believe it is imperative that all founders start their pitches by talking about the team. No matter who you are and what your background is, we as investors want to get to know you more than we want to get to know your company. Everyone has a unique story — some may be more traditionally impressive than others, but the common denominator between all successful pitches is the entrepreneur’s ability to convincingly articulate why they are going to win, regardless of their background.

As I said earlier, my favorite part about my job is getting to know entrepreneurs. I’d love to hear your story — [email protected]